Talking Down the Economy

By James D. Agresti

October 14, 2008

There are numerous factors that impact the U.S. economy, but one has been singled out by economists, media titans and leading politicians as a pervasive underlying force: The public mindset. This key dynamic is significantly influenced by people and institutions who have the public's ear. Though rarely discussed in the current news frenzy surrounding the economy, recent history sheds a great deal of light on the matter.

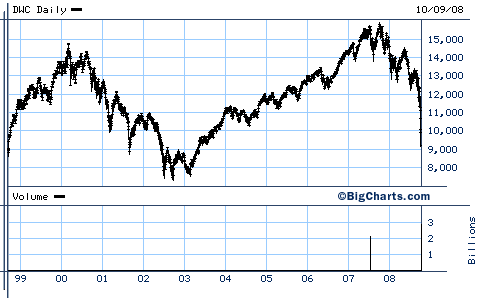

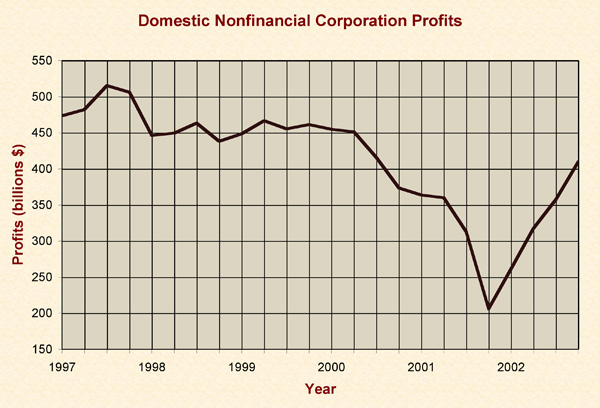

In early 2001 as Bill Clinton left and George Bush entered the Oval Office, GDP growth had sunk into negative territory,[1] the dot.com bubble had burst sending the stock market in a downward spiral,[2] [3] [4] and Treasury Department profit estimates for nonfinancial corporations, which were previously reported as growing for the past two years, were later found to be off by as much as 29.9% and had been in rapid decline.[5] [6] [7]

Not wanting to be blamed for economic

conditions that preexisted any policies

implemented by his administration, Bush and

other members of his team brought attention

to problems that beset the economy.[8] This was

greeted by a backlash from Democratic

leaders and prominent media outlets, who

objected that Bush was "talking down the

economy" and that this would erode public

confidence and trigger economic troubles.

Making the case that Bush's "talk" was

damaging the economy, an article in the Washington Post flatly stated that

economic indicators "deteriorated

considerably" following "a drumbeat of

ominous forecasts by the Bush

administration."

[9] In fact, it was later found

that GDP growth had sunk into negative

territory several months before Bush took

office.[10] Another article in the Post

quoted an economist who asserted, "What

happened is that a few politicians opened

their mouths and started to use the R-word

[recession]. And then newspapers started to

run big headlines about layoffs."

[11]

In a house editorial, the New York Times

lectured "it is important" that President

Bush "quit talking down the economy…."

[12] Likewise, a column in the Times took

Bush to task for not being a "cheerleader"

for the nation's economy.[13]

An article in Time magazine critiqued

President Bush and the media for being

pessimistic about the economy and pointedly

declared, "The worry factor is not to be

underplayed. Recessions and bear markets are

as much about psychology as fundamentals…."

[14]

In a Chicago Tribune editorial penned

by one of their senior writers, it was

stated that "public perception fuels the

nation's fiscal health," "the mind of the

consumer is the most important commodity in

the economy," and we will "never know for

sure how much" Bush's statements have

"directly contributed to the decline in

confidence."

[15]

Likewise, an Associated Press news

analysis faulted the Bush administration for

talking negatively about the economy,

asserting "there is no evidence that

economic growth has actually turned

negative," and quoting an economist who

analogized Bush's remarks on the economy to

a basketball coach who tells his team that

their last coach was "lousy" and "you're a

rotten team."

[16]

All of the above was made in concert with

similar assertions by Democratic politicians

and their economists. In March 2001, the

lead Democrats in the Senate and House of

Representatives held a joint press

conference proclaiming that the "Bush

administration has been talking down the

economy now for some time" and "what we're

seeing is a talking down of the economy."

[17]

[18]

[19]

In the midst of all this, Bush's concern

that he would be blamed for economic

conditions he had inherited became a

reality. Less than two months after he took

office,[20]

[21] an article was published in the New York Times with the headline, "60

Percent Favor Bush, but Economy Is Major

Concern." In it, it was reported that "some

Democrats are pointing fingers at Mr. Bush"

and quoted a financial analyst as stating,

"Everything just seems to be going in the

wrong direction now; there are so many job

cuts. People I know are losing their jobs.

This didn't happen during the Clinton

administration."

[22]

Less than two months later in May 2001, the

same press outlets that had recently warned

about the dangers of "talking down the

economy" were doing exactly that. Within the

space of only two articles published on the

same day in the New York Times and Washington Post, the following verbiage

was used in reference to the nation's

economic health:

"already sluggish," "weakness," "weakening,"

"weakened," "has been weakening," "even

weaker," "even more economic weakness," "big

job losses," "job-cutting," "rising

unemployment," "shrinking profits," "job

cuts," "jump in unemployment," "recession

fear," "job loss," "dashing hopes,"

"continuing corporate layoffs," "hiring

freezes," "pull back sharply on their

spending," "rising unemployment," "dampen

consumer spending," "pace of layoffs shows

no sign of abating," "falloff in hiring has

been so steep and so sudden," "most

forecasters expect the jobless rate to

rise," "layoffs renew recession fear,"

"tipping the economy into recession," "might

be nearing, or even in, a recession."

[23]

[24]

At the time these stories were published,

Bush had been in office for less than four

months and Congress had yet to pass his

first major economic proposal.[25] Furthermore,

the first federal budget of Bush's tenure

was still five months away from being

implemented.[26]

Since then, pessimistic characterizations of

the economy by the press and Democratic

politicians have continued unrestrained,

even in the face of robust economic

indicators to the contrary. Since most

people do not have the experience or context

to interpret economic statistics, they are

often left with little more than the spin

that press outlets place upon these figures.

Flagrant double standards have been employed by the

media in this regard, usually rising to a

peak during Presidential election years.

Media watchdog organizations and

commentators have documented obvious

patterns in such cases. For example:

• During the quarter preceding Bill

Clinton's victory over George H. Bush's bid

for a second term in the election of 1992,

97% of economic portrayals on the big three

television evening newscasts were negative.

Yet, this changed immediately and

drastically once the election was over, and

more than 60% of economic portrayals for the

remaining two months of the year were

positive. (Center for Media and Public

Affairs.)[27]

• Three key economic indices for the year

that preceded Bill Clinton's re-election in

1996 and George W. Bush's re-election in

2004 were as follows:

| 1996 | 2004 | |

| GDP growth | 4.0% | 3.2% |

| Unemployment | 5.5% | 5.6% |

| Inflation (CPI) | 3.0% | 2.5% |

Despite the fundamental similarities between

these figures, there was a distinct contrast

in media portrayals of the economy. For

example, in 1996 when Clinton was up for

reelection, Adam Nagourney of the New

York Times wrote, "the economy is good."

[31] Yet, as noted by columnist Jack Kelly, when

Bush was up for reelection in 2004, Nagourney declared the economy was

"faltering."

[32] Numerous examples of such

biased reporting on the economy have been

documented by right-leaning commentators and

organizations such as the Media Research

Center.[33]

[34]

[35]

[36]

[37]

Perhaps the most concrete indicator of

slanted economic reporting on a widespread

level is public opinion polls that show a

major disconnect between perception and

reality. As pointed out by libertarian

commentator Larry Elder, a November 2005

poll found 43% of Americans believed the

country was in a recession.[38]

[39] Yet, the year

leading up to this poll showed analogous GDP

growth, unemployment and inflation to the

year that led up to Clinton's reelection in

1996.[40]

[41]

[42]

With another presidential election upon us

and a Republican in the White House,

negatively skewed economic reporting is

climaxing, and in concurrence with this,

economic conditions are worsening. For

example, little more than a month ago on

August 28th, GDP growth for the previous

quarter was revised from 1.9% to 3.3% (which

happens to be

precisely the average of the past 25 years

and 3.8 points higher than when Bill Clinton

left office).[43]

Yet a snapshot of the New York Times

home page taken five hours after they

published this news item displays a pattern

consistent with media reporting in previous

elections. The positive economic development

was placed in an obscure location and given

a nondescript headline. Had this article

been placed prominently with an informative

caption, it would have undermined the story

that was given the lead position.[44]

In marked contrast, earlier in the same month when the initial (and lower) GDP figure was reported, it was made the lead headline and presented with a caption that read, "Economists construed the disappointing quarter as clear indication that the economy remains snagged in the weeds of a widening downturn." [45] The article itself also failed to mention that "the first release of many economic indicators," as explained in a text published by the Wharton School, "contains pieces of data that are far from reliable and thus considered preliminary." [46] [47]

Likewise, a few days later in the buildup to

the current financial crisis, Yahoo News

placed the following Associated Press

headline and caption at the top of their

news features:

Jobless rate jumps

to 5-year high of 6.1 percent (AP)

AP - The nation's unemployment rate zoomed

to a five-year high of 6.1 percent in August

as employers slashed 84,000 jobs, dramatic

proof of the mounting damage a deeply

troubled economy is inflicting on workers

and businesses alike.[48]

Increasing unemployment is a clear negative

development, but a rate of 6.1% is not far

off from the annual average of the past 25

years (5.8%).[49] This is not to deny the nation

is in troubled economic times, but given

what the press and politicians affirmed about

"talking down the economy" less than 8 years

ago, there can be little doubt that they

have played and are playing a major role in

damaging it now.

Sidebar: Economic Fallacies and Realities

With the media's linkage of

political fortunes to economic

statistics, several misconceptions

have gained ground in the public

mind. The first is the notion that

the credit and blame for general

economic conditions can be

rationally attributed to the

President.

The reach of the federal government

in the U.S. economy is pervasive,

and over time it has acquired

expansive powers that impact

economic conditions.[50] However, the

federal government consumes about

18% of the nation's GDP,[51] leaving the

vast majority of economic activity

in the hands of the American people.[52]

Thus, the statement in the Chicago

Tribune that "the mind of the

consumer is the most important

commodity in the economy."

Furthermore, while the executive

branch of the federal government has

broad powers that can influence the

economy, the Constitution vests

legislative and taxing authority in

the hands of Congress.[53]

[54] On top of

this, roughly two-thirds of all

federal expenditures are entitlement

programs like Social Security and

Medicare in which finances are

primarily controlled by laws made by

previous Congresses and Presidents.[55]

There are more than 60 parameters

that economists, journalists and

politicians analyze and slice in

making economic assessments and

portrayals.[56] Therefore, it is almost

always possible for partisans to

find bad news in a sea of good and

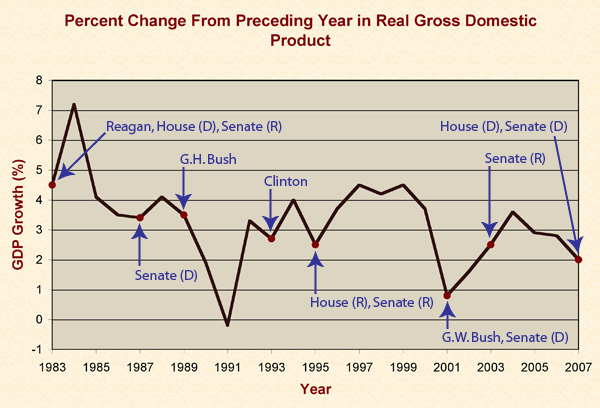

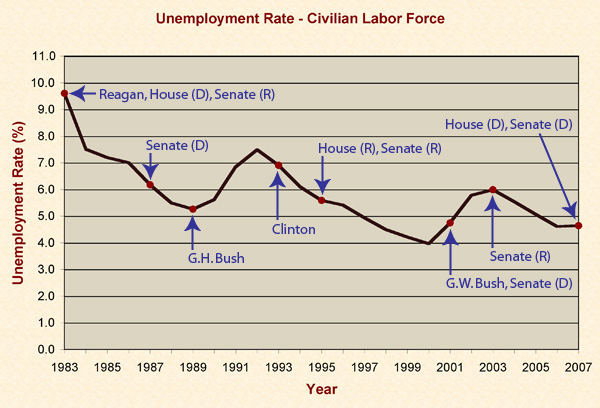

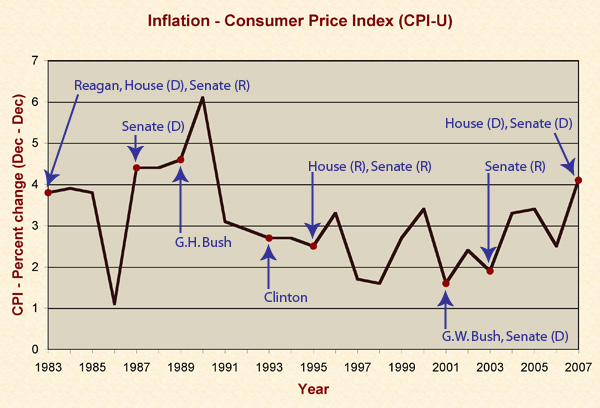

vice versa. However, three of the

most cited and regarded economic

indicators are GDP growth,[57]

[58]

unemployment,[59] and inflation (CPI).[60]

[61]

[62]

These are graphed below for the past

25 years along with a record of the

parties controlling Congress and

President.[63]

[1] Table 1.1.1: "Percent Change From Preceding Period in Real Gross Domestic Product." Bureau of Economic Analysis, U.S. Department of Commerce. Downloaded 10/3/2008, Last revised September 26, 2008. Line 1. http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

2001, 1st quarter: -0.5%

[2] Transcript: "Inside

the Dot.Com Crash." CNN Moneyline,

December 26, 2000.

http://transcripts.cnn.com/TRANSCRIPTS/0012/26/se.01.html

One year ago at this time, Internet stocks

were in the midst of an astonishing rally,

and their future seemed limitless. But since

then, investors have been facing a brutal

reality check, watching their shares fall

70, 80, 90 percent from their highs and in

some cases disappear completely.

[3] Web page: "Dow Jones

Wilshire Broad Market Indexes." Accessed

October 10, 2008 at

http://www.wilshire.com/Indexes/Broad/

The Dow Jones Wilshire 5000 Total Market

Index represents the broadest index for the

U.S. equity market, measuring the

performance of all U.S. equity securities

with readily available price data. No other

index comes close to offering its

comprehensiveness.

[4] Web page: "Dow Jones

Wilshire 5000 Composite Index." Accessed

October 9, 2008 at

http://www.wilshire.com/quote.html?symbol=dwc

Data plot for the past decade:

[5] Book: Guide to

Economic Indicators. By Richard Stutely.

Fifth edition. Bloomberg Press, 2003. Page

40: "[T]he rush to publish information often

means that figures are revised several times

as new information comes to hand, perhaps

causing major changes in interpretation. For

example, industrial production figures may

be based initially on sales and output data

and adjusted later to take account of

changes in inventories not caught in the

sales figures."

[6] Article: "Sunny

Clinton forecast leaves cloud over Bush." By

Robert Novak. CNN, August 9, 2002.

http://archives.cnn.com/2002/ALLPOLITICS/08/09/column.novak/

The Commerce Department's Bureau of Economic

Analysis estimates before-tax profits of

domestic nonfinancial corporations

quarterly. Revised figures last week showed

profits were really lower by 10.7 percent,

12.2 percent, 15.2 percent and 18 percent

for the four quarters of 1999. In 2000, this

gap became a chasm. The revised quarterly

profits for the election year are lower than

the announced figures by 23.3 percent, 25.9

percent, 29.9 percent and 28.2 percent.

[7] Table 1.14: "Gross

Value Added of Domestic Corporate Business

in Current Dollars and Gross Value Added of

Nonfinancial Domestic Corporate Business in

Current and Chained Dollar." Bureau of

Economic Analysis, U.S. Department of

Commerce. Downloaded 10/10/2008, Last

revised September 26, 2008. Line 36:

"Nonfinancial corporate business: Profits

before tax (without IVA and CCAdj)."

http://www.bea.gov/national/nipaweb/TableView.asp?Selected…

[8] Transcript: "CBS Evening News with Dan Rather." March 27, 2001. Rather: "President Bush is trying to distance himself from blame for economic problems and to deflect critics who say he isn't helping matters with repeated negative talk about it."

[9] Article: "Democrats

Accuse Bush of Helping to Slow the Economy;

White House Denies Aim Is to Sell Tax Cut."

By Dana Milbank. Washington Post,

March 16, 2001. Page A8.

http://www.washingtonpost.com/

The latest back-and-forth, coming amid

market turmoil, follows a drumbeat of

ominous forecasts by the Bush

administration. It began in December, when

Vice President-elect Cheney warned that the

country could be "on the front edge of a

recession." Since then, economic indicators

have deteriorated considerably.

[10] Table 1.1.1:

"Percent Change From Preceding Period in

Real Gross Domestic Product." Bureau of

Economic Analysis, U.S. Department of

Commerce. Downloaded 10/3/2008, Last

revised September 26, 2008. Line 1.

http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

2000, 3rd quarter (Jul-Sept): -0.5%

[11] Article: "With

Words, Bush Runs Economic Risk." By Glenn

Kessler and Paul Blustein. Washington

Post, March 15, 2001. Page A1.

http://www.washingtonpost.com/

Kenneth Goldstein, a Conference Board

economist… suggested that consumers have

seen little impact from the slowing economy,

but their long-term outlook had been

affected by what opinion makers and the

media were saying.

"What happened is that a few politicians

opened their mouths and started to use the

R-word," Goldstein ventured. "And then

newspapers started to run big headlines

about layoffs."

[12] House editorial: "A

Moment of Economic Suspense." New York

Times, March 14, 2001.

http://query.nytimes.com/gst/fullpage.html?res=…

No one has a magic formula for ensuring

prosperity. But there are important policy

tools available and good reasons to believe

that a recession is avoidable. The White

House and the Fed, as well as Congress, must

now work in concert to prop up consumer

confidence.

The Federal Reserve must continue to do its

part by further dropping interest rates to

encourage spending. It is important, too,

for President Bush to quit talking down the

economy in order to build Congressional and

public support for his tax cut.

[13] Article: "Washington

Memo; For Bush, a Chronicle Of Bad News

Foretold." By David E. Rosenbaum. New

York Times, March 19, 2001.

http://query.nytimes.com/gst/fullpage.html?res=…

Normally, presidents are cheerleaders for

the nation's economy. …

Now comes George W. Bush, who is presenting

what an analysis in The Financial Times last

week called ''the novel spectacle'' of a

president ''urging citizens to ignore good

economic news and focus on the bad.''

[14] Article: "Zap!" By

Daniel Kadlec and others. Time, Mar.

26, 2001.

http://www.time.com/time/magazine/article/0,9171,999526,00.html

The worry factor is not to be underplayed.

Recessions and bear markets are as much

about psychology as fundamentals, which is

precisely why the stock market--unable to

find something it can believe in--has worked

up such a sweat. To that extent, the media

may be fueling the pessimism. In January,

TIME put the worried faces of a family of

four on the cover and expounded on HOW TO

SURVIVE THE SLUMP. More depressing has been

the recent stream of daily headlines about

plunging stock prices. And in a high-risk

bid to win support for his tax cuts,

President Bush has been sounding alarm bells

that reach into every kitchen.

[15] Editorial: "Hold the

Soup; It Takes a Sound Mind to Drive a

Strong Economy; Public Perception Fuels the

Nation's Fiscal Health." By William Neikirk.

Chicago Tribune, February 11, 2001.

http://www.chicagotribune.com/

All this is based on a simple premise: The

mind of the consumer is the most important

commodity in the economy. And for a good

reason: Two-thirds of gross domestic

product, the market value of annual

production of goods and service, is consumer

spending. …

One will never know for sure how much

Greenspan and President Bush have directly

contributed to the decline in confidence. To

put it mildly, neither has been a

cheerleader, with the Fed chairman telling

Congress the economy was, in effect, near a

recession, and the president, pushing his

$1.6 trillion tax cut, warning the economy

may be "in danger."

[16] News analysis:

"Bush: Talking down economy to build up tax

cut?" By Tom Raum. Associated Press,

March 28, 2001.

He has been warning of dark clouds in the

economic skies for months, and his top

spokesman, Ari Fleischer, has referred to

the slowdown as an ''economic downturn,''

even though there is no evidence that

economic growth has actually turned

negative. …

David Wyss, chief economist at Standard &

Poor's Corp., said the consumer confidence

report suggests Americans ''are no longer

worried, or as worried, that the economy

will be in worse shape a year from now.''

Bush should start being a little more upbeat

himself, Wyss suggested. ''If you're a

basketball coach, and you come in and tell

your team 'my predecessor was a lousy coach'

and 'you're a rotten team,' that's not a way

to win the next game,'' he said.

[17] Article: "With

Words, Bush Runs Economic Risk." By Glenn

Kessler and Paul Blustein. Washington

Post, March 15, 2001. Page A1.

http://www.washingtonpost.com/

Democrats have begun making the case that

Bush's rhetoric has already crossed the line

and helped to dangerously undermine consumer

confidence at a delicate time…

Gene Sperling, who served as an economic

adviser to President Bill Clinton, said, "…

It is very possible that the president's

continued drumbeat on talking down the

economy has become a self-fulfilling

prophecy."

[18] Article: "Democrats

Accuse Bush of Helping to Slow the Economy;

White House Denies Aim Is to Sell Tax Cut."

By Dana Milbank. Washington Post,

March 16, 2001. Page A8.

http://www.washingtonpost.com/

"I think what we're seeing is a talking down

of the economy," House Minority Leader

Richard A. Gephardt (D-Mo.) said in a news

conference yesterday, suggesting President

Bush's pessimistic outlook is a bid to sell

his tax cut. "I think that kind of economic

leadership is irresponsible. I think it's

mismanagement of our economy."

[19] Article: "Democrats

put blame on Bush." By Dave Boyer. Washington Times, March 16, 2001.

http://washingtontimes.com/

"The Bush administration has been talking

down the economy now for some time," said

Senate Minority Leader Tom Daschle at a

Capitol Hill news conference with House

Minority Leader Richard A. Gephardt.

[20] Bush was inaugurated

January 20, 2001.

[21] Twentieth Amendment to the Constitution of the United States. Ratified January 23, 1933. https://justfacts.com/constitution.asp#Amendment20

Section 1. The terms of the President and

Vice President shall end at noon on the 20th

day of January, and the terms of Senators

and Representatives at noon on the 3d day of

January, of the years in which such terms

would have ended if this article had not

been ratified; and the terms of their

successors shall then begin.

[22] Article: "60 Percent

Favor Bush, but Economy Is Major Concern."

By Richard L. Berke and Janet Elder. New

York Times, March 14, 2001.

http://www.nytimes.com/2001/03/14/politics/14POLL.html?…

Already, some Democrats are pointing fingers

at Mr. Bush. Ben Deloach, 54, a poll

respondent from Norfolk, Va., said in a

follow-up interview, "Everything just seems

to be going in the wrong direction now;

there are so many job cuts." Mr. Deloach, a

financial analyst, added: "People I know are

losing their jobs. This didn't happen during

the Clinton administration." (Bush has yet

to enact a single budget, therefore these

layoffs are a result of the Clinton

administration.)

[23] Article: "U.S.

Jobless Rate Rose to 4.5% in April." By

Louis Uchitelle. New York Times, May

5, 2001.

http://query.nytimes.com/gst/fullpage.html?res=…

[24] Article: "Layoffs

Renew Recession Fear: April Job Loss Biggest

in Decade." By Steven Pearlstein and John M.

Berry. Washington Post, May 5, 2001.

Page A1.

http://www.washingtonpost.com/

[25] Article: "$1.35

trillion tax cut becomes law." By Kelly

Wallace. CNN, June 7, 2001.

http://archives.cnn.com/2001/ALLPOLITICS/06/07/bush.taxes/

President George W. Bush signed into law

Thursday the first major piece of

legislation of his presidency, a $1.35

trillion tax cut over 10 years.

[26] "Citizen's Guide to

the Federal Budget: Fiscal Year 2000."

Section 3: "How Does the Government Create a

Budget?" Government Printing Office,

Updated January 24, 2008.

http://www.gpoaccess.gov/usbudget/fy00/guide03.html

The President and Congress both play major

roles in developing the Federal budget.

The President's Budget

The law requires that, by the first Monday

in February, the President submit to

Congress his proposed Federal budget for the

next fiscal year, which begins October 1. …

The President's budget is his plan for the

next year. But it's just a proposal. After

receiving it, Congress has its own budget

process to follow. Only after the Congress

passes, and the President signs the required

spending bills has the Government created

its actual budget.

[27] Media Monitor: "It's

Still the Economy, Bill: How TV Economic

News Has Changed Since Clinton's Election."

Edited by S. Robert Lichter and Linda S.

Lichter. Volume 7, Number 5. Center for

Media and Public Affairs, May 1993.

http://www.cmpa.com/files/media_monitor/93may.pdf

Page 1:

… the ABC, CBS, and NBC evening newscasts

together…

Page 3:

(To measure news tone, we tally all

assessments of the overall economy and

individual sectors by reporters and sources.

This measurement derives from specific

positive and negative evaluations of

economic health, not inferences about

economic statistics.) … Through the entire

third quarter (July-Sept) of 1992, 97

percent of all sources turned thumbs down on

the economy's performance.

Then the gloom boom suddenly ended, as

positive assessments jumped from only three

percent to 50 percent during the fourth

quarter. From the November 3 presidential

election through the end of the year, over

60 percent of economic evaluations were

favorable.

[28] Table 1.1.1:

"Percent Change From Preceding Period in

Real Gross Domestic Product." Bureau of

Economic Analysis, U.S. Department of

Commerce. Downloaded 10/3/2008, Last

revised September 26, 2008. Line 1.

http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

|

1995-IV |

1996-I |

1996-II |

1996-III |

Average |

|

3.0 |

2.9 |

6.7 |

3.4 |

4.0 |

|

2003-IV |

2004-I |

2004-II |

2004-III |

Average |

|

2.7 |

3 |

3.5 |

3.6 |

3.2 |

[29] Table: "Unemployment

Rate - Civilian Labor Force - LNS14000000."

Bureau of Labor Statistics, U.S.

Department of Labor. Data extracted

October 3, 2008.

http://data.bls.gov/cgi-bin/surveymost?ln

|

1995 |

1996 |

|||||||||||

|

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Avg. |

|

5.5 |

5.6 |

5.6 |

5.6 |

5.5 |

5.5 |

5.6 |

5.6 |

5.3 |

5.5 |

5.1 |

5.2 |

5.5 |

|

2003 |

2004 |

|||||||||||

|

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Avg. |

|

6.0 |

5.8 |

5.7 |

5.7 |

5.6 |

5.8 |

5.6 |

5.6 |

5.6 |

5.5 |

5.4 |

5.4 |

5.6 |

[30] Table: "Consumer

Price Index, All Urban Consumers (CPI-U),

U.S. city average, All items." Bureau of

Labor Statistics, U.S. Department of Labor,

September 16, 2008.

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

|

CPI |

||

|

Sept 1995 |

Sept 1996 |

Increase |

|

153.2 |

157.8 |

3.0% |

| CPI | ||

|

Sept 2003 |

Sept 2004 |

Increase |

| 185.2 | 189.9 | 2.5% |

[31] Article: "The Year

of the Yawn." By Adam Nagourney. New York

Times, November 3, 1996.

http://query.nytimes.com/gst/fullpage.html?res=…

The economy is good, the country is not at

war and President Clinton has rebounded from

the depths of his unpopularity just two

years before. …

''When you're an incumbent, and the economy

is doing well,'' Mr. Stephanopoulos said

recently, ''boring is good.''

[32] Article: "U.S.

economy is fine: The only thing faltering is

media objectivity." By Jack Kelly. Pittsburgh Post-Gazette, April 04, 2004.

http://www.post-gazette.com/pg/04095/295352.stm

[33] Article: "Threats

and Responses: The Overview; Rice Would Take

More Questions From 9/11 Panel." By Adam

Nagourney & Richard W. Stevenson. New

York Times,

http://query.nytimes.com/gst/fullpage.html?res=…

With the economy faltering and Democrats so

united, Mr. Bush's terrorism credentials are

portrayed by his supporters as the strongest

assets he has going against Mr. Kerry.

[34] Column: "The Media's

Elastic Economy." By L. Brent Bozell III.

Media Research Center, November 2, 2004.

http://www.mediaresearch.org/BozellColumns/newscolumn/2004/col20041102.asp

[35] Report: "One

Economy, Two Spins." By Dan Gainor. Free

Market Project, Media Research Center,

October 14, 2004.

http://www.freemarketproject.org/specialreports/2004/jobs_study/sr20041014.asp

[36] Column: "Under

Democrats, Slower Growth was Seen as Good

News." Media Research Center, October

29, 2004.

http://www.mediaresearch.org/realitycheck/2004/fax20041029.asp

[37] Article: "Predicting

Presidential Winners: Is It the Economy, or

Is It the Media?" By Rich Noyes. Media

Research Center, June 2, 2000.

http://www.mediaresearch.org/medianomics/2000/mn20000602.asp

[38] Column: "Democratic

delusions." By Larry Elder. WorldNetDaily,

December 22, 2005.

http://www.worldnetdaily.com/index.php?pageId=34030

Forty-three percent of Americans, according

to a recent American Research Group poll,

said the economy was in a recession. …

… Most economists define a recession as

three consecutive quarters of falling real

gross national product. Yet for the last 10

quarters, the economy grew at an average of

more than 3 percent, with the latest quarter

coming in at 4.3 percent. Inflation and

interest rates remain low, with

homeownership at an all-time high. …

Unemployment, coming in at 5 percent,

remains lower than the average unemployment

rate during the '70s, '80s and '90s.

[39] Poll Update:

"American Research Group, Economic

Upheaval." National Journal Group,

December 19, 2005.

Nat'l Econ In Recession? …

11/05 – 43%

[40] Table 1.1.1:

"Percent Change From Preceding Period in

Real Gross Domestic Product." Bureau of

Economic Analysis, U.S. Department of

Commerce. Downloaded 10/3/2008, Last

revised September 26, 2008. Line 1.

http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

|

1995-IV |

1996-I |

1996-II |

1996-III |

Average |

|

3.0 |

2.9 |

6.7 |

3.4 |

4.0 |

|

2004-IV |

2005-I |

2005-II |

2005-III |

Average |

|

2.5 |

3.0 |

2.6 |

3.8 |

3.0 |

[41] Table: "Unemployment

Rate - Civilian Labor Force - LNS14000000."

Bureau of Labor Statistics, U.S.

Department of Labor. Data extracted

October 3, 2008.

http://data.bls.gov/cgi-bin/surveymost?ln

|

1995 |

1996 |

|||||||||||

|

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Avg. |

|

5.5 |

5.6 |

5.6 |

5.6 |

5.5 |

5.5 |

5.6 |

5.6 |

5.3 |

5.5 |

5.1 |

5.2 |

5.5 |

|

2004 |

2005 |

|||||||||||

|

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Avg. |

|

5.4 |

5.4 |

5.2 |

5.4 |

5.2 |

5.1 |

5.1 |

5.0 |

5.0 |

4.9 |

5.1 |

5.0 |

5.2 |

[42] Table: "Consumer

Price Index, All Urban Consumers (CPI-U),

U.S. city average, All items." Bureau of

Labor Statistics, U.S. Department of Labor,

September 16, 2008.

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

|

CPI |

||

|

Sep 1995 |

Sep 1996 |

Increase |

|

153.2 |

157.8 |

3.0% |

|

CPI |

||

|

Oct 2004 |

Oct 2005 |

Increase |

|

190.9 |

199.2 |

4.3% |

[43] Table 1.1.1:

"Percent Change From Preceding Period in

Real Gross Domestic Product." Bureau of

Economic Analysis, U.S. Department of

Commerce. Downloaded 10/9/2008, Last

revised September 26, 2008. Line 1.

http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

2001, 1st quarter: -0.5%

NOTE: Average of annual data from 1983-2007.

[44] Article: "Economic

Growth Revised Higher." By Michael M.

Grynbaum. New York Times, August 29,

2008.

http://www.nytimes.com/2008/08/29/business/29econ.html?_r=…

Gross domestic product rose at a 3.3 percent

clip in the second quarter, the Commerce

Department said, a significant jump over the

original estimate of 1.9 percent growth.

G.D.P., the broadest measure of the nation's

economic activity, is considered a good

barometer of America's economic health.

[45] Article: "G.D.P.

Grows at Tepid 1.9% Pace Despite Stimulus."

By Peter S. Goodman. New York Times,

August 1, 2008.

http://www.nytimes.com/

NOTE: The article was subsequently retitled

"More Arrows Seen Pointing to a Recession"

and is located at

http://www.nytimes.com/2008/08/01/business/01econ.html?hp

[46] Book: The Secrets

of Economic Indicators. By Bernard

Baumohl. Fourth edition, Wharton School

Publishing, 2005.

Page 21:

Government agencies and private groups that

supply economic data to the public are under

tremendous pressure to get it out quickly,

and that's not easy. … It's a hurried

process where accuracy and completeness take

a back seat at times to getting the

information out on deadline. For this reason

the first release of many economic

indicators contain pieces of data that are

far from reliable and thus considered

preliminary.

Of course, to many investors, it makes

little difference whether the initial data

is reliable. They'll trade on these numbers

anyway because these figures represent the

very latest information they can get on the

economy. Later, though, as more information

is received and after statisticians have had

a chance to review their computations, the

preliminary figures undergo one or more

revisions. Though revisions to earlier data

are also read by investors, they generally

do not spark much trading because by then

the information refers to a time period that

has long since passed. Investors usually

focus on the future, not the past.

Economists, however, take revisions more

seriously because the new figures can affect

their forecasts of economic activity.

[47] Book: Tracking

America's Economy. By Norman Frumkin.

M.E. Sharpe, 2004. Page 21:

Economic indicators are developed from data

obtained in surveys of households,

businesses, and governments, and from tax

and regulatory reports submitted to the

federal and state governments. … Because

policymakers in the presidential

administration, Congress, and the Federal

Reserve System want the indicators as soon

as possible following the month or quarter

to which they refer, the data are initially

provided on a preliminary basis and are

subsequently revised as more complete and

accurate survey information is received. The

use of preliminary and revised information

results from the tension between the need

for both timely and accurate data. Revisions

are sometimes substantial, and therefore it

is important that preliminary information be

treated as tentative.

[48] Article: "Jobless

rate jumps to 5-year high of 6.1 percent

(AP)." By Jeannine Aversa. Associated

Press, September 5, 2008.

http://news.yahoo.com/

NOTE: This article was displayed as the top

headline on Yahoo! Mail at 9/5/08 11:00 AM.

[49] Table: "Unemployment

Rate - Civilian Labor Force - LNS14000000."

Bureau of Labor Statistics, U.S.

Department of Labor. Data extracted

October 3, 2008.

http://data.bls.gov/cgi-bin/surveymost?ln

NOTE: To establish annual unemployment

rates, averages were taken of the months in

each year from 1983 to 2007. These figures

were then verified through a cross-check

with data from the Social Security

Administration and then averaged over the 25

year period.

[50] For an explanation

of how the federal government came to

acquire such power, see

https://justfacts.com/socialspending.basics.asp

[51] Report: "The Federal

Government's Financial Health: A Citizen's

Guide to the 2007 Financial Report of the

United States Government." Accessed October

11, 2008 at

http://www.whitehouse.gov/omb/financial/reports/citizens_guide.pdf

Page 6: "Since World War II, federal revenue

as a share of GDP has been roughly constant

at around 18 percent."

[52] Article:

"Economics." Contributor: Henry J. Aaron,

Ph.D. (Senior Fellow, Brookings

Institution). World Book Encyclopedia,

2007 Deluxe Edition.

Every day, millions of men and women in the

United States work on farms and in factories

and offices. These men and women produce

trillions of dollars worth of goods and

services each year. The government does not

tell the people where to work. It does not

decide where most of the factories should be

built. Nor does the government dictate what

prices will be charged for most goods and

services. Yet the work is done, the prices

are set, and most Americans get the products

they need.

How does the economy work with so little

planning? The desire of most people to

improve their own welfare makes it work. In

the United States, people are free to

improve their economic standing. They may

try to find a job where they please and

generally may spend their income as they

wish. Of course, the government takes part

in many economic activities. But for the

most part, individuals and private

businesses run the American economy.

[53] Constitution

of the United States. Signed September

17, 1787. Enacted June 21, 1788.

https://justfacts.com/constitution.asp

Article I, Section 1: "All legislative

Powers herein granted shall be vested in a

Congress of the United States, which shall

consist of a Senate and House of

Representatives."

Article I, Section 7: "All Bills for raising

Revenue shall originate in the House of

Representatives; but the Senate may propose

or concur with Amendments as on other

Bills."

Article I, Section 8: "The Congress shall

have Power To lay and collect Taxes, Duties,

Imposts and Excises, to pay the Debts and

provide for the common Defence and general

Welfare of the United States…"

[54] "Citizen's Guide to

the Federal Budget: Fiscal Year 2000."

Section 3: "How Does the Government Create a

Budget?" Government Printing Office,

Updated January 24, 2008.

http://www.gpoaccess.gov/usbudget/fy00/guide03.html

The President and Congress both play major

roles in developing the Federal budget.

The President's Budget

The law requires that, by the first Monday

in February, the President submit to

Congress his proposed Federal budget for the

next fiscal year, which begins October 1. …

The President's budget is his plan for the

next year. But it's just a proposal. After

receiving it, Congress has its own budget

process to follow. Only after the Congress

passes, and the President signs the required

spending bills has the Government created

its actual budget.

[55] "Citizen's Guide to

the Federal Budget: Fiscal Year 2000."

Section 3: "How Does the Government Create a

Budget?" Government Printing Office,

Updated January 24, 2008.

http://www.gpoaccess.gov/usbudget/fy00/guide03.html

• Discretionary spending, which accounts for

one-third of all Federal spending, is what

the President and Congress must decide to

spend for the next year through the 13

annual appropriations bills. It includes

money for such activities as the FBI and the

Coast Guard, for housing and education, for

space exploration and highway construction,

and for defense and foreign aid.

• Mandatory spending, which accounts for

two-thirds of all spending, is authorized by

permanent laws, not by the 13 annual

appropriations bills. It includes

entitlements--such as Social Security,

Medicare, veterans' benefits, and Food

Stamps--through which individuals receive

benefits because they are eligible based on

their age, income, or other criteria. It

also includes interest on the national debt,

which the Government pays to individuals and

institutions that hold Treasury bonds and

other Government securities. The President

and Congress can change the law in order to

change the spending on entitlements and

other mandatory programs--but they don't

have to.

[56] Book: Guide to

Economic Indicators. By Norman Frumkin.

Fourth edition. M.E. Sharpe, 2006. xiii:

"The book explains the basic features of

more than sixty statistical measures of the

U.S. economy."

[57] Book: Guide to

Economic Indicators. By Richard Stutely.

Fifth edition. Bloomberg Press, 2003. Page

29: "All the major industrial countries now

use GDP as their main measure of national

economic activity."

[58] Book: Tracking

America's Economy. By Norman Frumkin.

M.E. Sharpe, 2004. Pages 3-4: "The overall

performance of the economy is reflected in

its economic growth. … This chapter

highlights the gross domestic product (GDP)

as the primary measure of economic growth."

[59] Book: Guide to

Economic Indicators. By Norman Frumkin.

Fourth edition. M.E. Sharpe, 2006. Page 245:

"The unemployment rate is a major indicator

of the degree to which the economy provides

jobs for those seeking work."

[60] Book: Tracking

America's Economy. By Norman Frumkin.

M.E. Sharpe, 2004. Page 271: "This chapter

focuses on the consumer price index (CPI) as

the prime measure of inflation and deflation

in the economy. The CPI is the most widely

cited measure of price change…"

[61] Book: Guide to

Economic Indicators. By Richard Stutely.

Fifth edition. Bloomberg Press, 2003. Page

21: "The consumer price index (CPI) is the

indicator most people use to track

inflation." Page 215: "CPIs are the most

timely and best understood inflation

indicators. … Consumer expenditures and GDP

deflators are often better guides to

inflation, but usually they are not

available quickly enough."

[62] Book: Guide to

Economic Indicators. By Norman Frumkin.

Fourth edition. M.E. Sharpe, 2006. Page 48:

"The CPI-U represents all urban households

including urban workers in all occupations,

the unemployed, and retired persons; it

accounts for about 87 percent of the

noninstitutional population."

[63] Summary of

information from the following sources:

1) "U.S. Presidential Election Results." Encyclopædia Britannica, 2007.

http://www.britannica.com/

2) Web Page: "Party Divisions of the House

of Representatives, 1789-Present." Office

of the Clerk, United States House of

Representatives. Accessed November 17,

2007 at

http://clerk.house.gov/art_history/house_history/partyDiv.html

3) Web Page: "Party Division in the Senate,

1789-Present." Historical Office, United

States Senate. Accessed June 25, 2008 at

http://www.senate.gov/pagelayout/history/one_item_and_teasers/partydiv.htm

SUMMARY:

1983: Reagan is President. Democrats have

commanding majority* in House and

Republicans have majority in Senate.

1985: Reagan's second term.

1987: Democrats acquire commanding majority*

in Senate.

1989: G.H. Bush takes office.

1993: Clinton takes office.

1995: Republicans acquire majority in House

and Senate.

1997: Clinton's second term. Republicans

acquire commanding majority* in Senate.

2001: G.W. Bush takes office. Democrats

acquire majority in Senate. #

2003: Republicans acquire majority in

Senate.

2005: Bush's second term. Republicans

acquire commanding majority* in Senate.

2007: Democrats acquire majority in House

and Senate.

* "Commanding majority" arbitrarily defined

as at least 20% more members than the

opposing party.

# Control of the Senate switched back and

forth during this period with Democrats

holding it for the majority of time.

[64] Table 1.1.1: "Percent Change From Preceding Period in Real Gross Domestic Product." Bureau of Economic Analysis, U.S. Department of Commerce. Downloaded 10/3/2008, Last revised September 26, 2008. Line 1. http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=…

[65] Table: "Unemployment

Rate - Civilian Labor Force - LNS14000000."

Bureau of Labor Statistics, U.S.

Department of Labor. Data extracted

October 3, 2008.

http://data.bls.gov/cgi-bin/surveymost?ln

[66] Table: "Consumer

Price Index, All Urban Consumers (CPI-U),

U.S. city average, All items." Bureau of

Labor Statistics, U.S. Department of Labor,

September 16, 2008.

ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt